货币基金一年收益怎么计算

Title: Understanding Annual Returns of Money Market Funds

In the realm of investments, money market funds serve as a popular choice for investors seeking stability and modest returns. These funds primarily invest in shortterm, highquality debt securities, making them relatively lowrisk compared to other investment vehicles. However, understanding the annual returns of money market funds requires delving into several key factors that influence their performance.

1. Composition of Money Market Funds:

Money market funds typically invest in various instruments such as Treasury bills, commercial paper, certificates of deposit (CDs), and shortterm bonds issued by governments, municipalities, or corporations. The primary goal is to preserve capital while generating income through interest payments.

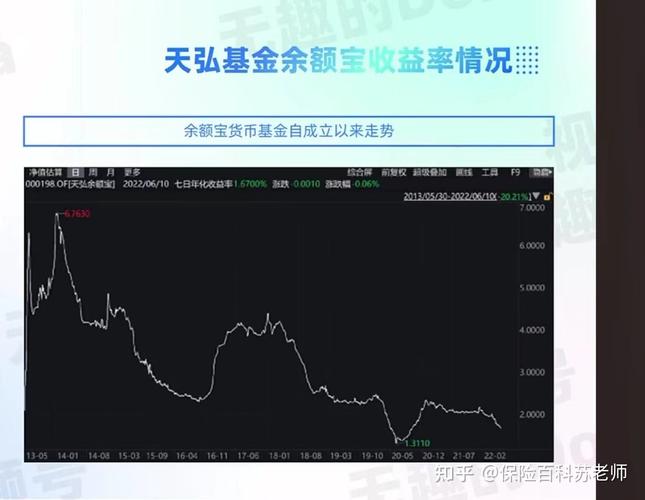

2. Interest Rate Environment:

The annual return of a money market fund is closely tied to prevailing interest rates. When interest rates rise, money market funds tend to offer higher returns as they can invest in newly issued securities at the higher rates. Conversely, when interest rates decline, fund returns may decrease as the yields on underlying investments decline.

3. Expense Ratios:

Expense ratios represent the annual fees charged by the fund management company for managing the portfolio. These fees are deducted from the fund's assets and can impact the net returns investors receive. Generally, money market funds have low expense ratios compared to other types of mutual funds, but it's essential to consider these costs when evaluating overall returns.

4. Market Conditions and Economic Factors:

Various market conditions and economic factors can influence the performance of money market funds. For instance, changes in liquidity levels, credit quality of underlying securities, and overall market sentiment can impact returns. Economic indicators such as inflation rates and central bank policies also play a crucial role in shaping the investment landscape for money market funds.

5. Risk Considerations:

While money market funds are relatively lowrisk investments, they are not entirely riskfree. Investors should be aware of factors such as credit risk, liquidity risk, and interest rate risk. Although rare, there have been instances where money market funds experienced losses due to defaults or market disruptions.

Guidance and Recommendations:

1.

Diversification:

Consider diversifying your investment portfolio beyond money market funds to mitigate risk and potentially enhance returns. Including a mix of asset classes such as stocks, bonds, and real estate can provide a more balanced approach to investing.2.

Monitor Interest Rate Trends:

Stay informed about changes in interest rates and their potential impact on money market fund returns. Adjust your investment strategy accordingly to capitalize on rising rate environments or protect against declining rates.3.

Review Expense Ratios:

Compare expense ratios across different money market funds and opt for funds with lower fees to maximize your net returns over time.4.

Stay Informed:

Keep abreast of market conditions, economic indicators, and regulatory developments that may affect money market funds. This awareness can help you make informed decisions about your investments.In conclusion, understanding the annual returns of money market funds requires considering various factors such as fund composition, interest rate environment, expenses, market conditions, and risk factors. By staying informed and adopting a diversified investment approach, investors can make sound decisions to achieve their financial goals while managing risk effectively

免责声明:本网站部分内容由用户上传,若侵犯您权益,请联系我们,谢谢!联系QQ:2760375052