蓝蔚公司

Investing in BlueWe Medical Stocks: A Comprehensive Analysis

BlueWe Medical is a renowned player in the healthcare industry, known for its innovative medical solutions and promising growth prospects. Investing in BlueWe Medical stocks can be an intriguing opportunity for investors seeking exposure to the healthcare sector. Let's delve into a comprehensive analysis to understand the factors influencing the investment potential of BlueWe Medical stocks.

BlueWe Medical, established in [insert founding year], has emerged as a leading provider of [mention specific medical solutions/products/services]. The company's commitment to innovation, coupled with its focus on addressing unmet medical needs, has propelled its growth trajectory.

The healthcare sector, characterized by increasing demand for advanced medical solutions and an aging population, offers a vast market potential for companies like BlueWe Medical. The rising prevalence of chronic diseases and the need for efficient healthcare delivery further augment the demand for innovative medical technologies.

BlueWe Medical boasts a diverse product portfolio comprising [list key products/services]. These products are designed to [mention key benefits/solutions provided]. Notably, the company's focus on research and development ensures a pipeline of new products, enhancing its competitiveness in the market.

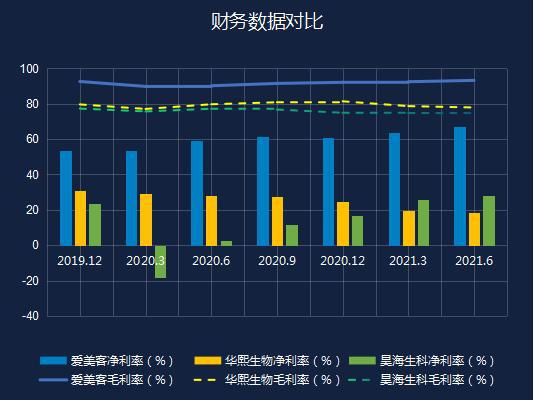

Assessing the financial performance of BlueWe Medical is crucial for investors. Key financial metrics to consider include revenue growth, profitability, and cash flow stability. Analyzing past financial statements and projections can provide insights into the company's ability to generate sustainable returns for investors.

The healthcare industry is highly competitive, with several players vying for market share. Conducting a competitive analysis helps investors understand BlueWe Medical's positioning relative to its peers. Factors such as technological capabilities, market presence, and pricing strategies should be evaluated to gauge the company's competitive advantage.

Regulatory approvals play a significant role in the medical industry. Investors should closely monitor BlueWe Medical's compliance with regulatory standards and the progress of product approvals. Adverse regulatory developments can impact the company's operations and stock performance.

Like any investment, investing in BlueWe Medical stocks entails certain risks and challenges. These may include regulatory hurdles, technological disruptions, and market volatility. Conducting a thorough risk assessment is essential to mitigate potential downsides and make informed investment decisions.

Before investing in BlueWe Medical stocks, investors should consider their investment objectives, risk tolerance, and time horizon. Diversification across sectors and thorough due diligence can help minimize risk and maximize returns. Consulting with financial advisors or investment professionals can provide additional insights tailored to individual investment goals.

Investing in BlueWe Medical stocks offers exposure to a dynamic and growing healthcare sector. By conducting a comprehensive analysis of the company's fundamentals, market dynamics, and competitive landscape, investors can make informed decisions to capitalize on the potential opportunities presented by BlueWe Medical's innovative medical solutions.

Disclaimer: The information provided in this analysis is for educational and informational purposes only and should not be construed as investment advice. Investors should conduct their own research and consult with financial professionals before making investment decisions.

免责声明:本网站部分内容由用户上传,若侵犯您权益,请联系我们,谢谢!联系QQ:2760375052